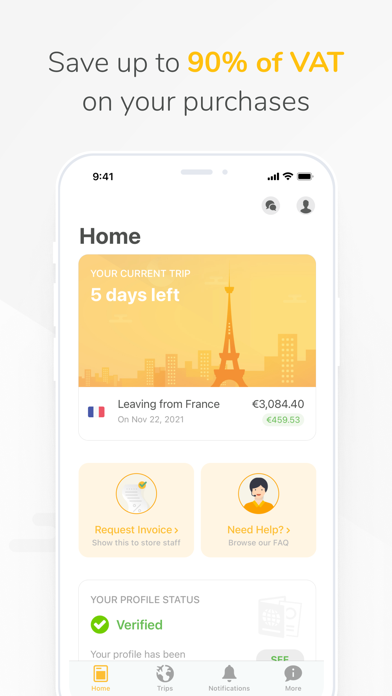

More than 100.000 users trust ZappTax to get their VAT refunds for purchases in France, Belgium, and Spain. Heres why...

ADVANTAGES

Reliability: ZappTax is the first digital tax-refund operator approved by the tax and customs authorities. We’ve been operating since 2017.

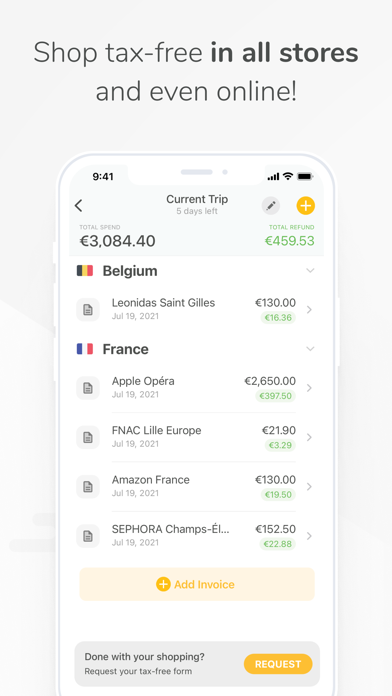

Usable everywhere: You can use ZappTax for tax-free shopping at ANY shop in France, Belgium and Spain, whether in-store or online.

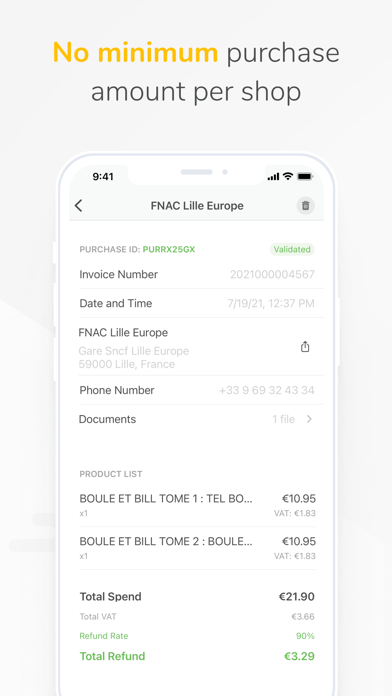

No restrictions: With no minimum purchase per store and per day, you can shop with peace of mind!

Easy: Our 100% digital procedure happens entirely on your smartphone. Generate tax refund forms and get customs validation without messy paperwork.

Amazing value: You get your money at the best rates in the business, and using the refund method of your choice (Bank transfer, Credit card, PayPal, ...)

Great customer service: We offer 24/7 messaging and phone support if you have any questions or problems.

HOW DOES IT WORK?

It’s simple!

Step 1: Download the app for free and complete your profile.

Step 2: Fill in the dates of your stay in the European Union.

Step 3: When shopping, ask the merchant for a “VAT invoice made out to ZappTax”. Photograph your invoices and upload them to the app or forward them by email to [email protected].

Step 4: At the end of your stay, click to request the automatic generation of your tax-free forms. You will get one or more tax refund forms showing all of your purchases.

Step 5: Validate your tax refund forms electronically at customs before leaving the EU by scanning the forms barcode at a self-service kiosk (PABLO device in France and DIVA in Spain) or by presenting your passport to a customs agent in Belgium.

And that’s all! ZappTax will process your refund and pay you using the method of your choice.